Southeast Asia's electric motorcycle market: a policy-driven blue ocean worth hundreds of billions of dollars

I. Market status and growth potential

As one of the regions with the highest number of Motorcycles in the world, Southeast Asia is expected to reach a Motorcycle market size of US$32.94 billion in 2024, of which Indonesia is the core market with 84% of motorcycle ownership. However, the penetration rate of electric motorcycles is less than 5%, and the market potential needs to be released urgently. The Indonesian government has proposed a "oil-to-electric" plan, with the goal of Electric motorcycles accounting for 20% (1.8 million units) in 2025 and a complete ban on the sale of fuel motorcycles in 2040. Driven by this policy, the Southeast Asian Electric motorcycle market is expected to grow at a compound annual growth rate of 13%, exceeding US$1 billion in 2029.

II. Policy dividends and industrial layout

Indonesia's policy increase:

The Indonesian government has introduced vehicle purchase subsidies (7 million rupiah per vehicle, about US$460), tax incentives (imported vehicles are tax-free until 2025), and plans to invest in 63,000 charging stations. In 2024, an additional 10,000 subsidy quotas will be added to cover ordinary citizens, and the efficiency of policy implementation will be improved. In addition, Indonesia cooperates with China to build battery factories (such as the CATL 15GWh project) and use the advantages of nickel resources to build a local supply chain.

Multi-country linkage in Southeast Asia:

Vietnam promotes the export of electric motorcycles through tax breaks, and exports to China will increase by 17% in 2024; Thailand relies on the automotive industry chain to deploy battery production, with the goal of 30% of new energy vehicles in 2030; the Philippines has passed the "Electric Vehicle Industry Development Act" to clarify the construction target of charging piles, and plans to have electric vehicles account for 30% of the new car market in 2030.

III. Market demand and consumption trends

Short-distance commuting rigid demand:

Short-distance travel in Southeast Asian cities is concentrated in 10-20 kilometers. Electric motorcycles have become the first choice due to their low cost (purchase cost is 5%-10% of fuel vehicles) and high efficiency. Indonesian online car-hailing platforms Grab and Gojek plan to electrify their fleets, which is expected to drive demand growth in the commercial market.

Environmental protection and cost advantages:

The operating cost of electric motorcycles is only 1/3 of that of fuel vehicles, and zero emissions are in line with environmental protection trends. Air pollution is serious in cities such as Jakarta, Indonesia (PM2.5 index has exceeded the standard for a long time), and electrification can significantly improve air quality.

IV. Competitive landscape and technological breakthroughs

Dominant Chinese brands:

Chinese companies such as Tailing and BYD are rapidly expanding through localized production (such as Tailing Indonesia Factory) and battery swap models (SWAP occupies 70% of the battery swap market). In 2024, China's exports of electric two-wheeled vehicles to Indonesia accounted for 59%, with significant cost advantages.

Japanese brands accelerate transformation:

Honda launched electric models such as EM1 e and CUV e:, and Yamaha released NMAX Turbo equipped with electric CVT technology, trying to share the high-end market. However, Japanese brand electric models are relatively expensive (Honda CUV e: is priced at 59.65 million rupiah), and the layout of charging facilities lags behind.

Technological innovation breaks the deadlock:

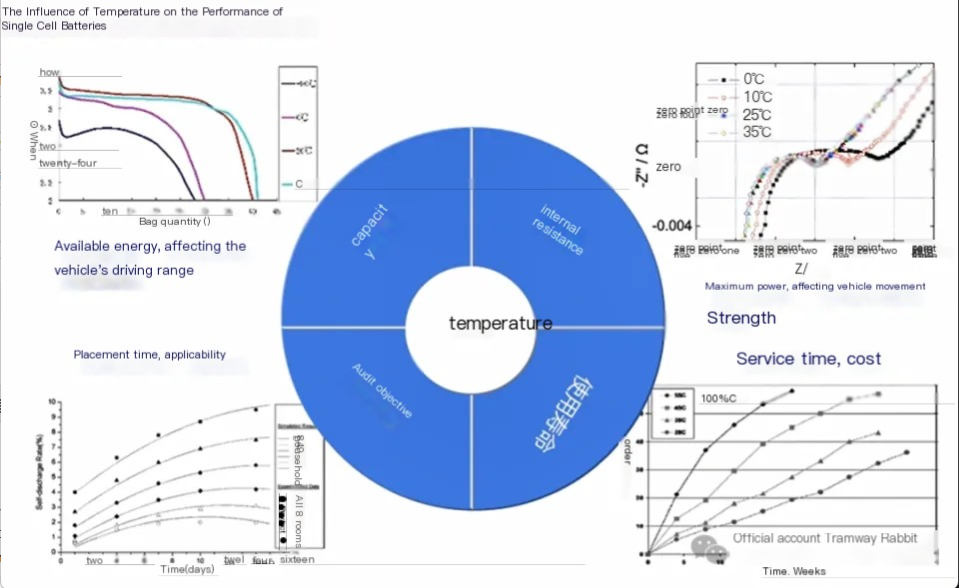

High-temperature battery technology (such as Huawei's graphene battery) solves the climate challenges in Southeast Asia, and the driving range is increased to more than 100 kilometers. The popularization of the battery swap model (1,500 battery swap stations in Indonesia) shortens the charging time and improves the user experience.

V. Challenges and coping strategies

Infrastructure shortcomings:

Indonesia has insufficient number of charging piles (the target for 2025 is 14,000, and there are only 961 at present), and the standards are not unified. The government needs to promote the construction of multi-brand compatible battery swap stations and encourage companies to invest.

Insufficient consumer awareness:

43% of consumers are concerned about the driving range, and 29.8% think charging is inconvenient. Companies need to improve awareness through test drive experience, education and publicity, and optimize battery technology.

Policy implementation efficiency:

In 2023, the application rate for electric motorcycle subsidies in Indonesia was only 1.2%, reflecting the complexity of the process. The government should simplify the application conditions and expand the coverage of subsidies.

VI. Future Outlook and Investment Opportunities

Market Growth Points:

Commercial Field: The electrification of food delivery and logistics industries is accelerating. In 2024, 30% of Indonesia's electric two-wheeled vehicle sales will come from the B-end.

Shared Travel: SWAP and Grab cooperate to promote the battery swap model. It is expected that the proportion of shared electric motorcycles will reach 15% in 2025.

Battery Recycling: Indonesia plans to establish a battery recycling network to promote the circular economy.

Investment Advice:

Technology Research and Development: Focus on high-temperature batteries and fast charging technology to enhance product competitiveness.

Localized Production: Utilize Indonesia's nickel resources and policy preferences to establish battery and vehicle production lines.

Battery Swap Ecosystem: Layout a network of battery swap stations and cooperate with platforms to expand the user base.

Conclusion

The Southeast Asian electric motorcycle market is in a period of double dividends driven by policies and technological iterations. With its resource endowment and policy determination, Indonesia is expected to become a regional electrification hub. Despite infrastructure and cognitive challenges, the cost advantages of Chinese brands, the technological accumulation of Japanese brands, and the ecological innovation of local companies will jointly drive the market into an explosive period. In the next five years, Southeast Asia is expected to become the fastest growing market for electric motorcycles in the world, providing investors with opportunities worth hundreds of billions of dollars.

Add comment

Add comment: